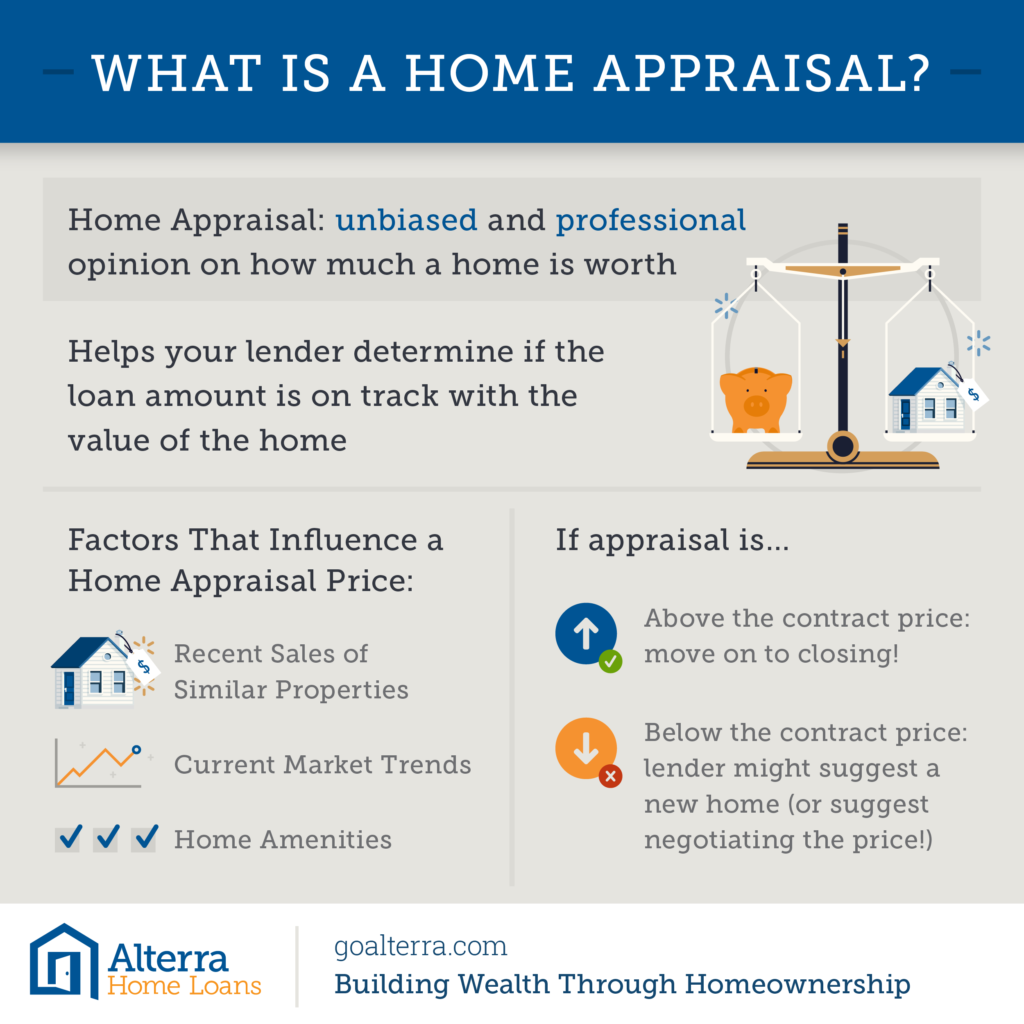

Once under contract, lenders require an appraisal prior to closing. An appraisal is quite different from a home inspection. A home appraisal is an unbiased and professional opinion on how much the home is worth. This is a required step by lenders that ensures their investment. An appraisal determines the worth of the home and ensures the lender is not providing more money than what the home is worth. This works as a guarantee to the lender’s investment into the home in case the property ever went into default by the buyer. The appraisal price ensures that the lender is likely to recoup their money if this were to occur and they were forced to sell the home either as a short sale or foreclosure.

Once under contract, lenders require an appraisal prior to closing. An appraisal is quite different from a home inspection. A home appraisal is an unbiased and professional opinion on how much the home is worth. This is a required step by lenders that ensures their investment. An appraisal determines the worth of the home and ensures the lender is not providing more money than what the home is worth. This works as a guarantee to the lender’s investment into the home in case the property ever went into default by the buyer. The appraisal price ensures that the lender is likely to recoup their money if this were to occur and they were forced to sell the home either as a short sale or foreclosure.

Once the contract is accepted, an appraisal timeframe is stipulated within the contract. The lender hires an Appraisal Management Company (AMC) to complete the task and provide documentation to the lender. The average cost of an appraisal is $500. This is usually tacked onto the mortgage fees or the total is requested by the lender from the buyer.

What Influences an Appraisal and the Appraisal Price

Formulating an appraisal price is determined by numerous factors, some of which do not include the home itself. Here are some of the major factors of a home appraisal:

- Recent Sales of Similar Properties: Homes within the area that have similar square footage, room/bathroom ratios, lot size and footprints are often used to help determine an average for the area, which is factored into the final number. The more recent sales in an area, the more accurate the number.

- Current Market Trends: If the market is hot or cold affects the final number of an appraisal as well. If the home where to go on the market and sit, the lender would have to invest more money into the home, costing additional money. Hot markets raise the appraisal price for buyers.

- Home Amenities: Sure, the home may be 2500 sq. ft. but is it the opposite of an open floor plan? This can be a deterrent to many buyers, meaning the home will not sell as quickly and/or its value drops. Does the home have damaged vinyl? Does it not have a garage? All the home’s amenities can factor into the final number.

What Happens After the Appraisal?

Now that the appraisal is complete and the appraised value has been determined by the third-party appraiser, the final negotiations can begin. If the appraisal is above the contract price, the transaction can continue onto closing. If the appraisal is below the contract price, the lender will determine if you can proceed in purchasing the home, or if you’ll have to look for something else. It is possible to negotiate a reduction, but often a tough battle to win. This is where having a good relationship with the lender comes into play.

Remember, an appraisal is a requirement to close on any property. A lender will not lend money without the completion of an appraisal, even if there is a home inspection.